Analysis of previous deals:

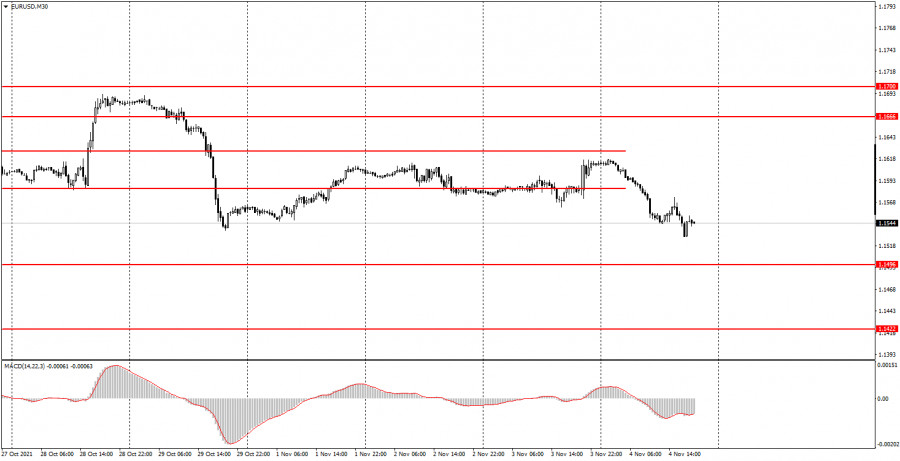

30M chart of the EUR/USD pair

The EUR/USD pair was traded more actively on Thursday than in the previous few days. Despite the fact that the most important event of the week (the Federal Reserve meeting) happened yesterday, the markets have been impressed by the results (the meeting) all today. Thus, a fairly strong movement in the pair should come as no surprise. Also, the strengthening of the US currency should not be surprising, since yesterday it was announced that the Fed's quantitative stimulus program would be curtailed. And be that as it may, this is the hawkish decision of the Fed. Thus, the US dollar should have appreciated, and he did, albeit after some time. However, the technical picture of the 30-minute TF has not changed much after all these events and movements. There is still no trend, trend, or trend line. Therefore, we still do not advise novice traders to use the MACD indicator as a signal source. Also, it cannot be concluded now that the US dollar will continue to strengthen. It is quite possible that tomorrow we will see the opposite of today's movement.

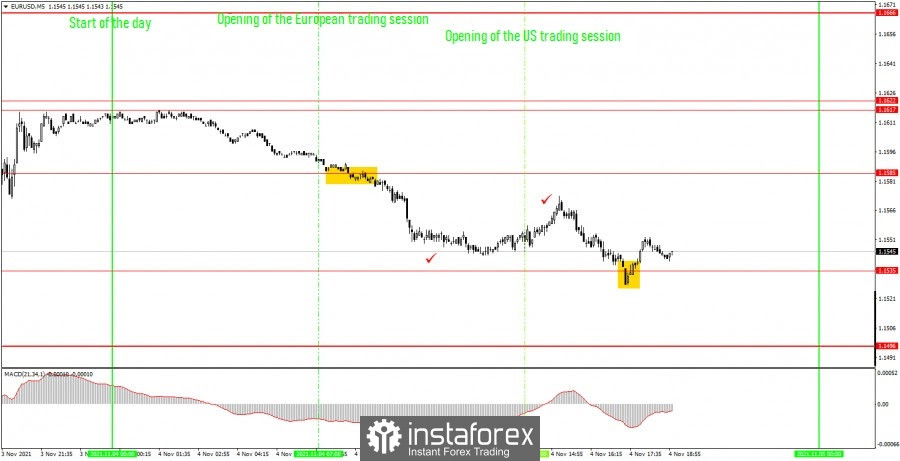

5M chart of the EUR/USD pair

On a 5 minute timeframe, Thursday's move was almost perfect. First, a small number of signals were generated. Secondly, they were all quite strong and profitable. Third, today's macroeconomic statistics and fundamental events did not have much impact and did not spoil the movement. In principle, today we can only highlight the index of business activity in the services sector of the eurozone (first tick) and the speech of the head of the European Central Bank President Christine Lagarde (second tick). As you can see, after these events, the movement did not change much. As for the trading signals, the first one was formed at the very beginning of the European trading session, when the price broke the level of 1.1585. Novice traders could open short positions here, which should have been closed only around the 1.1535 level in the US trading session. The price bounced off the latter almost perfectly, which served as a signal to close sell orders at a profit of about 32 points. Also, this deal could be closed at any Take Profit (30-40 points). On the signal of a rebound from the level of 1.1535, it was possible to open long positions, but this signal was formed in the late afternoon, so it remained at the discretion of the traders themselves. In any case, it turned out to be profitable.

How to trade on Friday:

There is still no trend or side channel on the 30-minute timeframe at this time. Therefore, the current movement is generally very difficult to describe in words: it is neither sideways nor trendy. It is still not very convenient to trade on this TF, and we still do not recommend tracking signals from the MACD indicator. We advise you to wait for the formation of a trend line or trend channel. On a 5-minute timeframe, the key levels for November 5 are 1.1496, 1.1535, 1.1585, 1.1617 - 1.1622. Take Profit, as before, is set at a distance of 30-40 points. Stop Loss - to breakeven when the price passes in the right direction by 15 points. At 5M TF, the target can be the nearest level if it is not too close or too far away. If it is located - then you should act according to the situation or work according to Take Profit. Friday promises to be no less interesting day than Thursday or Wednesday. On this day in the United States will be published one of the most important reports for the American economy - NonFarm Payrolls. The last two reports have been weak. If the third is the same, then tomorrow we may already observe the fall of the US currency.

Basic rules of the trading system:1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.com