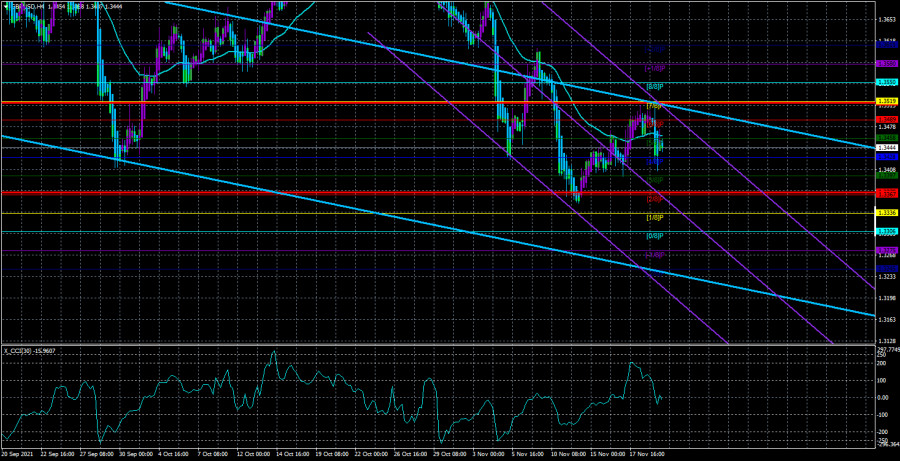

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

The GBP/USD currency pair also collapsed on Friday. And this is although Christine Lagarde's speech had nothing to do with the British pound for obvious reasons. And there were simply no other important events in the UK or the States on Friday. In the early morning, a retail trade report for October was published, but its data turned out to be higher than forecasts, so they should have provoked the growth of the British currency. Nevertheless, the pound sterling also crashed down and began to do it synchronously with the euro/dollar pair. Thus, it turns out a strange picture when both major currency pairs began to fall at the same time, but the reason for this was not the "foundation" from the United States (as usually happens), but the speech of the head of the ECB. However, it should be recognized that the pound sterling stopped this "outrage" quite quickly and began to recover losses. In general, Friday's volatility for the pound/dollar pair was lower than for the euro/dollar pair, which is extremely rare. What can be said about the technical picture? On Friday, there was a consolidation below the moving average line on the 4-hour TF, so the trend has changed to a downward one at the moment. Both linear regression channels are still directed downward, so the downward trend is not in doubt at this time. If the global technical picture breaks down for the euro/dollar pair, then it looks quite stable for the pound/dollar pair. In other words, the pound sterling continues to adjust against the upward trend of 2020, so the current downward movement may end at any moment. But there are also difficulties here. First, the corrective movement is always difficult to work out. Second, the fundamental background is now extremely difficult for the pound, so it is impossible to make a long-term forecast.

The Bank of England can breathe new life into the pound, or it can help it continue to fall.

In the last few days, we have been doing nothing but discussing problems related to the protocol on the customs regime at the border of Northern Ireland. However, this topic may last for several more months. In principle, now you can stock up on popcorn, as a new series called "EU-UK negotiations" begins. Let's leave this topic for a while. Today we would like to draw the attention of traders to the fact that the Bank of England may dramatically change the mood of traders in December, as has happened in recent weeks for the euro/dollar pair. If it has become clear in the European Union recently that there is no point even hoping for a tightening of monetary policy, then in the UK the BA may raise the rate as early as December. And it's not a joke. However, we recall that at the November meeting, two members of the monetary committee voted in favor of raising the rate. This is although even the QE program has not yet begun to collapse. Nevertheless, if 3 or 4 members vote for a rate hike at the December meeting, this could already help the pound a lot. If five people vote "yes", the rate will be raised, and the pound may fly into the clouds. As we said earlier, the tightening of monetary policy is a very strong "bullish" factor for the national currency. Therefore, the pound may receive strong support. Moreover, we have been waiting for a new round of growth of the pair by 400-500 points for two weeks. On the 24-hour TF, you can see what is being discussed. It should also be noted that the pound does not have as many reasons to fall as the euro currency. There is no smell of a new quarantine in the UK, the Bank of England is moving to start tightening monetary policy, and the economy is recovering at least. Of course, there are a huge number of geopolitical problems in the Kingdom that can result in new crises, but for now, it's just a time bomb that can still be defused. Local factors suggest that the pound should not collapse against the dollar like the euro.

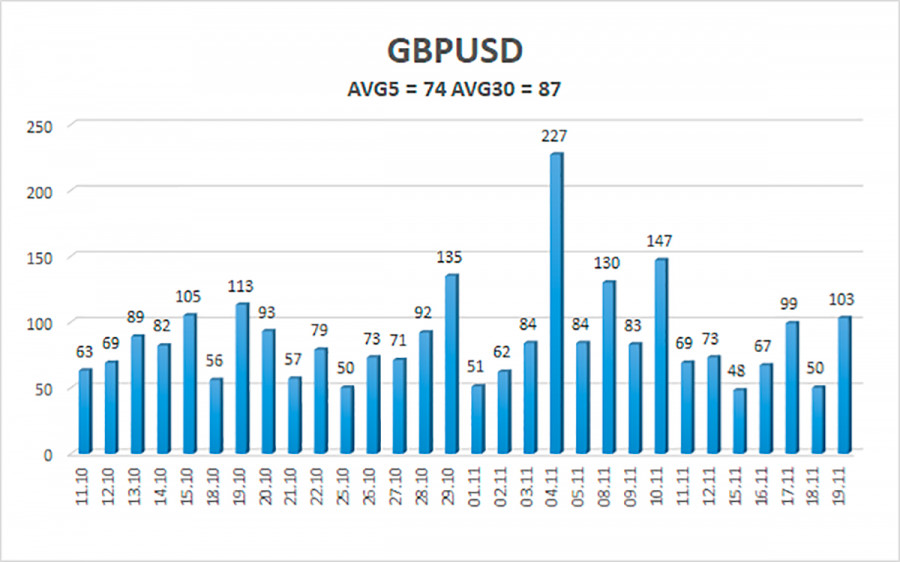

The average volatility of the GBP/USD pair is currently 74 points per day. For the pound/dollar pair, this value is "average". On Monday, November 22, we expect movement inside the channel, limited by the levels of 1.3370 and 1.3518. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.3428

S2 – 1.3397

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3458

R2 – 1.3489

R3 – 1.3519

Trading recommendations:

The GBP/USD pair overcame the moving on the 4-hour timeframe. Thus, at this time, it is necessary to remain in short positions with the targets of 1.3397 and 1.3367 levels if the price remains below the moving average. Buy orders can be considered in the case of a confident consolidation of the price above the moving average with targets of 1.3518 and 1.3550 and keep them open until the Heiken Ashi turns down.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

The material has been provided by InstaForex Company - www.instaforex.com